Convert your physical wallet into a virtual wallet and make your all transaction easy and secure. What is Mobile Wallet and which wallet is best?

Table of Contents

What is Mobile Wallet?

Mobile wallet is a virtual platform where your bank or account detail is linked and you can make a secure transaction to others without visiting your branch.

This way is easy and convenient and anyone can use it easily. This service you can operate using your smartphone or featured phone. In any smartphone operating system, you can use it.

Simply we say mobile wallet is an android or ios app where the user can make different types of transaction e.g – bill payment, money transfer, and various services available.

How mobile wallet works?

The different Mobile wallet uses different payment processing models to made transactions. The payment processing models are

- Mobile Web Payment:- Maximum of platforms uses a mobile web platform, this model is easy and it can available for more users. The name of some mobile web payment interface is UPI, NEFT, and RTGS, etc.

- NFC (Near field Communication):- The name states this service can usable when the user and customer are available at a place. This service is not usable in every device because for using this service you have to require particular hardware in your device.

Mainly popular wallets used UPI and another some banking wallets use NEFT, IMPS or RTGS. Most of the wallets upi because you can make any kind of transaction using UPI.

Using UPI how Mobile Wallets work

The name defines Unified Payment Interface, NPCI manages UPI service. Consider if you send an amount from your account to another bank account then your amount goto NPCI and NPCI verifies and send it to your enter account ( to sender).

For a successfully upi transaction you have required a UPI id if you create a wallet that functions using UPI. The UPI id consists of all account details to identify.

Take an example You have sent money to another account using her account information then there is no problem.

You cannot remember every relative’s or friend’s account number, for solving this issue and making cashless UPI is available for users to make transactions easy.

If you want to send money to your friend and you don’t remember her acc detail, so you can use her UPI id which is her phone number with her wallet id.

Trusted Top 10 Mobile Wallets in 2019

There are many apps there who provide different feature but i will explain the top 10 trusted mobile wallets.

1.Google Pay

Google pay is developed by Google and its partner banks are ICICI, HDFc, and Citi bank, etc. The interface of Google pay is simple and easy to use. First Google pays to start in the US on 11 Sept 2015.

Google makes a partnership with different international banks to provide different services to users. In date 28 Aug 2018 Google pay is released in India named Google Tez.

Google pay Offers different services in India, a special service is provided by Google is Nearby Payment. Google pay supports 31 countries in the world.

Using nearby payment you can make a transaction with displaying your account information to the receiver. Using this service you can transfer money without sharing your account or upi id to other users.

Features of G Pay

- Make transactions in google pay for free.

- Use utility for getting an extra reward or cashback.

- For any trouble contact with g pay any time.

- Refer and earn using referral code in g pay.

- Google pay available in 31 countries.

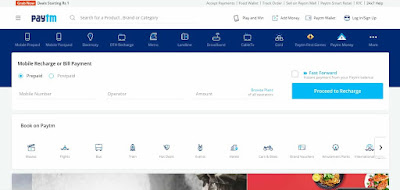

2.Paytm

Paytm is available in India and it starts in the year August 2010 by Vijay Shekhar Shankar. Paytm is a combination of e-commerce and mobile wallet.

Paytm is a purely Indian company whose growth is high as compare to other Indian mobile wallet companies. It also available all the features of online transactions.

Paytm app has another program available in one app. Paytm Mall is the e-commerce program where you can shop your favorite product from the mall and pay them in a single app.

For providing better service to user Paytm payment Bank is available. If you don’t have an account then you have created a zero balance Paytm payment bank account.

Paytm Payment bank has zero external charges, its interest rate is 4.00% per annum. Payment Fd account is also available where you can fix your fund for high returns. Its interest rate is up to 8%.

Paytm merchant account helps to store to make her shop digital, and receive payment directly from customers. Customers can use stores UPI id or barcode for online payment.

Features of Paytm

- All online features are available like e-commerce, payment banks.

- Your account is secure with the KYC feature.

- There are zero hidden charges.

- If you create a Payment bank then you get a debit card.

- High Fd interest up to 8%.

- Paytm services available in both web or app platform.

- Paytm available for merchants, it avails for free.

3.Amazon Pay

Amazon is used for mainly for e-commerce. In India amazon starts mobile wallet service because in India the growth of online transactions increases rapidly.

To make a value in wallet amazon launches her online service which is Amazon Pay. Amazon pay is available in the Amazon shopping app. Amazon serves different services like utility payment, mobile, Dth recharge and online money transfer using UPI interface.

Amazon has a cashback wallet service where all transaction cashback saves in the wallet and you can redeem cashback only in the amazon pay platform.

Features of Amazon Pay

- Amazon Pay serves different cashback schemes in every month.

- In amazon, you can send money using barcode or UPI id.

- The most important point is you get 24/7 support on amazon.

4.Phonepe

Previously phonepe is owned by other but now phonepe is Flipkart’s official wallet app. The first upi app who creates user attraction by serving different cashback offers to customers.

Phonepe app is available for both android and ios platforms. Using phonepe you make multiple transactions and earn different rewards with the different transactions.

This app is available in 11 Indian religion languages for better customer experience. Phonepe wons different awards and recognition.

In 2018 phonpe recognized by NPCI for driving the largest numbers of merchant transactions to upi network, and many more awards wins phonepe.

Phonepe avails for merchants to make stores online and store owners receive online payments from customers.

Feature of Phonepe

- From upi to bill payments all online facilities available in phonepe.

- You got cashback for every transaction.

- Receive Flipkart order cancellation amount in 2-5 hours.

- You can create a business account in phonepe.

- In the merchant account, you also get different cash backs to both.

- There is no hidden charge for users.

- You can communicate with customer service easily.

5.BHIM

Bharat Interface for Money (BHIM) is official app of the Indian government and this app is developed by NPCI. The motive of this app is to make India cashless.

This app interface is easy and any beginner can use this app easily. BHIM upi id is the primary upi id of every user. The Bhim UPI id is easy to remember (youraddress@upi).

BHIM app is available in 13 languages, for both platform ios and android. This app allows receiving payments from users with zero fees.

The minimum transaction you can do in bhim is ₹1 to ₹1 Lakh/day. Bhim app also serves different services to users like mobile recharge, utility bill payment, etc.

It is in the fifth position because this service is provided by NPCI, and its customer support is good.

Features Of BHIM

- BHIM is easy to use.

- It accepts all bank platforms.

- You can earn from the referral.

- It is available in 13 languages for better customer engagement.

- Customer support of BHIM is excellent.

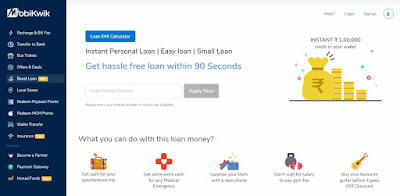

6.MobiWiki

Mobiwiki is an Indian company and its launch in India 2019. An IIT graduate will develop this app. The beginning of this app is launched for different bill payment.

After this app successful, Mobiwiki launces e-wallet services in 2012, and this app uses the platform upi for the transaction. Mobiwiki will serve different services like utility payments, upi transactions, etc. Mobiwiki is available for both mobile and web platforms.

Special feature of Mobiwiki is it offers loans to Mobiwiki users. In Mobiwiki offer tab, you can surf or select the best offer.

Mobiwiki payment partnership with uber in July 2015. You can make payment using mobiwiki wallet.

Feature of Mobiwiki

- Make your transaction easy and secure.

- In mobiwiki every transaction provides rewards.

- You get an offer & deal page in mobiwiki for serving the latest offers.

- You get super cash from the transaction, which makes your transaction free.

7. Yono SBI

Yono is a mobile or web-based platform and is offered by the state bank of India (SBI). Yono SBI developed by the State Bank of India for serving different online services of the bank.

Yono is available for both android and IOS platforms, and every state bank user can avail of this app for using sbi services.

This app makes sbi user life easy and smart. Yono app provides different banking services like online balance inquiry, money transaction using NEFT, IMPS, RTGS or upi.

This app is basically used for NEFT and RTGS. In this app upi service is available but there is no such good features of upi available.In this app for NEFT and RTGS takes charges for every transaction, according to bank policy charges are vary.

One biggest feature of this app is you get customer support from your bank directly. Using m-passbook service you can check your transaction details.

Features of Yono SBI

- For any query, you can directly contact your bank directly.

- Using the m-passbook feature check your transaction specifically.

- Yono sbi app is available in both platform ios and android.

- You get a liter version of the Yuno app for low capacity devices.

8.Freecharge

The simplest and easiest bill payment method is freecharge. Freecharge is founded by Kunal Shah and Sandeep Tandon on 15 Aug 2010.

All the mobile wallet services try to serve better services to users, some companies succeed in the journey and some companies try to improve her strategies.

Freecharge is a large online bill payment platform, where different kind of recharge is available for consumers. This makes human life simple and easy.

Freecharge also tries to increase its subscribers by making partnerships with different companies. It serves different offers to the consumer for gaining users into it.

Features of Freecharge

- You get all kinds of operators for recharge or bill payment.

- Freecharge app is available for both android and ios program.

- This app is available on the web and app platforms.

- It gives special recharge for every prepaid recharge.

9.Airtel Payment Bank (Airtel Money)

Airtel money is developed by airtel. Airtel is the largest cellular network operator in India. Airtel Money is running on upi interface.

Airtel money is coming under with airtel payment bank. Airtel payment bank is a free platform where you can create a free payment bank account.

You get a virtual master card in airtel payment bank. In airtel payment bak you get all services of a bank that are free with good interest rate.

For creating an airtel payment bank account you have to complete the full KYC process through airtel agent, it free of cost.

If you successfully complete KYC then after you get a virtual master card which was you can use for any transaction.UPI service is available for easy transactions.

Airtel payment bank offers all types of prepaid services like mobile recharge, electricity bill payment, etc.

For making transactions in airtel, you have to add money in airtel wallet and utilize all of the services of airtel thanks. There are no hidden charges of airtel.

Features of Airtel Money

- The best feature of airtel money is it serves a virtual master card at zero cost.

- You get varieties offers at various transactions.

- Transfer your money using upi easily.

10.JioMoney Wallet

Jio money is developed by Reliance Industries. It is an app launched by reliance for making secure digital transactions.

This app is available for both android and ios platforms. You can make all kinds of transactions in jio money and earn attractive rewards.

Its interface is easy, anyone can use this app. If you don’t have an account then you can create its own payment bank i.e Jio Payment Bank.

Make your all transaction easy with the Jio money wallet. It provides different offers like a Loyalty card, Sodexo Meal Pass, etc.

Jio Money app runs in beta version after completion of beta reliance launches its full version. In the full version, you get more offers as compare to jio money (Beta).

Features of Jio Money

- Get a simple interface and easy to use.

- Schedule your payments in a minute.

- You can set up your jio money wallet app in 2 minutes.

- Create a Jio payment bank account in 2 minutes.

- Easily add your business detail in My account section.

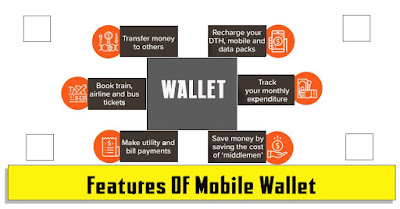

What kind of Payments You can do using Mobile Wallet?

Mobile wallets provide all services of your branch, you got maximum services from your bank. Different mobile wallet operates provides different services, and attract users to use her wallet.

You can Send and Receive money using the wallet, any kind of bill payment ( mobile recharge, electricity bill payment, broadband bill payment, gas bill payment, etc), book any train or bus ticket.

The main advantage of upi is it can’t take any extra charge to avail of these services.

Send and Receive Money

You can send money to any account or upi id using mobile wallets, there is no certain charges for money transfer to others or self.

- Your Account – Other Account ( using acc and ifsc)

- Your Account – Other Account (Using Upi Id)

- Your Account – Other Account (Verifying Phone no.)

- Your Account – Other Account (Using Upi Id)

- Your Account – Other Account (Using request, nearby friend)

In a day you make 10 upi transactions and the limit is ₹1 Lakh/day, this limitation is available for every upi id. If your daily upi transaction limit is exceeded then you can use imps or NEFT.

Bill payment

All bill payments in one app, there are zero hidden charges. If you pay you to bill using mobile wallets then every wallet owners provide different rewards for every bill payments.

Pay you all utility bills in a place like electricity, gas, water, municipality, dth, landline, mobile recharge, data card, and banking bills like credit card bill, insurance bill, etc.

Book Train or Bus Ticket

They made some partnerships with irctc and different bus franchises for ticket booking directly using her wallet. You also get a cashback if you book any ticket using the app.

Another different payment options are there in mobile wallets because this your virtual wallet and any kind of online transaction you can do here.

Are Mobile Wallets safe?

Obviously, mobile wallets are secure because all mobile wallets run using api of NEFT, RTGS, IMPS, and UPI. All the online transaction runs using govt api and govt. uses a highly secured algorithm in different transaction methods.

If without your information some money is debited from your account then you’ve returned the debited amount from the company.

Use trusted mobile wallet platforms, don’t use unverified apps, always install apps from play store and always stay alert from fraud calls. Don’t share your upi pin or passcode with others.